Copper is starting to look very bullish … and the smart money knows it. And we may be on the cusp of the next leg higher, a leg that could put a lot of money into your pockets.

I’ll get to how to play this move in a bit.

First, let’s look at why copper is bubbling higher.

Supply Is Tight and Getting Tighter

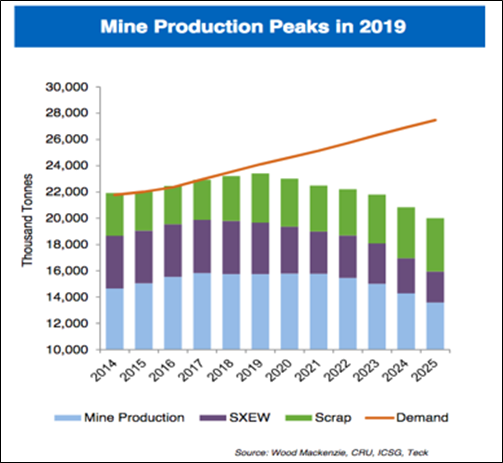

We’ve already hit “peak copper”. By that, I mean, the amount of copper coming out of the world’s copper mines probably peaked last year, as this chart from Wood Mackenzie shows.

|

Well, they can always mine more, right?

Not at recent prices.

In an interview last year, Robert Friedland of Ivanhoe Mines Ltd. (OTCQX: IVPAF) said, “The copper price probably needs to double … for the average low-grade copper porphyry in Peru or in Chile to become viable.”

And even if miners wanted to add new production, it takes YEARS to bring new mines online.

That’s supply. What about demand?

The Green Boom

The copper boom has been fueled in part by surging demand for industrial commodities from China. Its economy is already recovering from the COVID-19 pandemic. The rest of the world should follow, igniting suppressed demand for industrial metals — especially copper — worldwide.

But that’s not the only reason. The price of copper has a supercharger, in the form of global acceleration towards pro-green policies.

Heck, one of the first executive orders signed by the Biden administration was to re-join the Paris Agreement, with all its green energy/low pollution goals. Green energy — windmills, solar, power distribution, electric vehicles and more — requires more copper.

So we’re seeing a surge in demand while supply is stagnant or even declining.

This supply/demand squeeze recently led The Goldman Sachs Group, Inc. (NYSE: GS) to put out a note, saying: “Copper’s current price strength is just the first leg of a structural bull market.”

At the same time, Goldman yanked its forecast for copper prices higher.

Goldman believes the copper market is facing the tightest market conditions in a decade, and it should remain tight into 2022 and 2023.

So, the general trend in copper should be higher. Now, let me show you why I believe we are at an inflection point for both copper and copper miners.

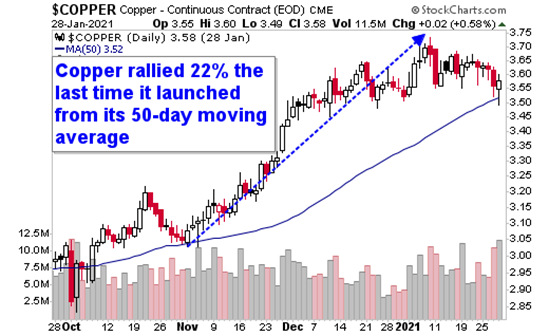

Here’s a daily chart of copper …

|

After a rally last year, Copper has spent 2021 consolidating its last big surge. On the far right, you can see copper is starting to bounce from its 50-day moving average. The last time that happened, copper rallied by 22%.

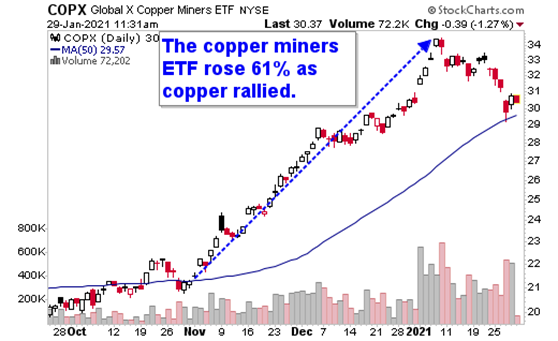

And what does that mean for miners? Let’s look at a chart of the Global X Copper Miners ETF (NYSE: COPX), a basket of leading miners.

|

You can see that copper miners rallied 61% compared to the metal’s 22%.

Why? Because miners are leveraged to the metal. As the price of copper goes up, mining costs remain the same. That means profit margins for miners widen like the Grand Canyon.

It helps miners in other ways, too. Let me give you a real-world example. Freeport-McMoRan (NYSE: FCX) has the huge Grassberg copper/gold mine in Indonesia. The company forecasts 2021 EBITDA (earnings before interest, taxes, depreciation and amortization) of $8 billion, with copper at $3.50 a pound for the rest of the year, on sales of 3.8 billion pounds.

However, each 10-cent rise in copper prices results in Freeport’s EBITDA increasing by $425 million over the course of 2021. Copper is already at $3.64 per pound and rising.

In other words, rising copper prices could turn Freeport into a profit machine. There are plenty of other copper producers — HudBay Minerals Inc. (NYSE: HBM), Teck Resources Ltd. (NYSE: TECK), BHP Group (NYSE: BHP) and Southern Copper Corp. (NYSE: SCCO) come to mind.

The opportunities abound in copper. Smart investors will make the most of it.

All the best,

Sean

P.S.- I’m clearly a fan of metals, but like all wise investors, I keep my eyes looking across the entire market. That’s why I need to share this opportunity with you. Dr. Martin Weiss has just released an urgent three-part video series, “Future Shock 2021”.

In it, he reveals a strategy that safely and prudently invests in the top tech stocks that are leaving brick-and-mortar stores in the dust.

These videos will be taken down soon. Click here to watch them now.