Corn went “limit up” in Chicago earlier this week. Limit up is when a futures contract for a commodity rises by the most allowed by the Chicago Board of Trade.

This is the first time that corn has surged like this since 2014. It’s the latest indicator that corn is starting a wild bull market, one that could be very profitable for you.

You might be thinking, “I don’t trade futures contracts. I can’t profit from this.” Well, that’s not true because in this issue, I’ll give you two ways to play it, including how my Wealth Megatrends subscribers are making the most of it without trading a single futures contract or option.

Corn isn’t the only agricultural commodity that’s doing the zoom-zoom. Soybeans and wheat hit their highest levels since 2014. They all have a common denominator — Chinese demand.

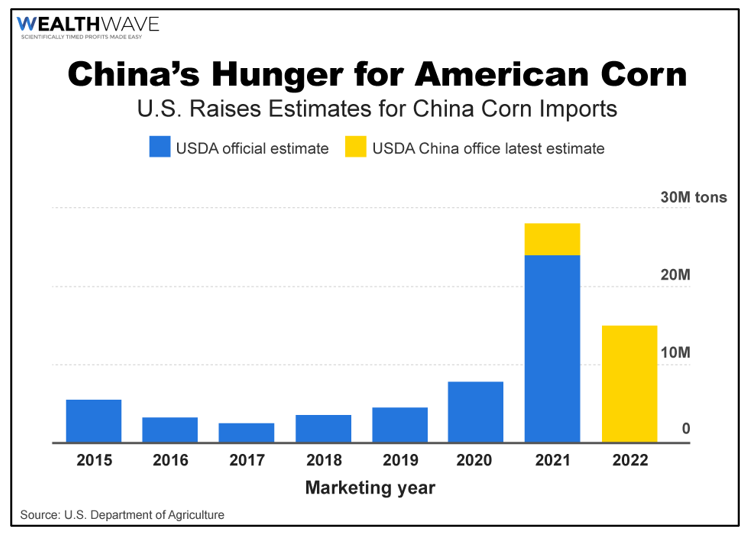

The U.S. Department of Agriculture expects China to import a record 28-million metric tons of corn this year. What’s more, China is so hungry for grain that it’s already scooping up the NEXT U.S. crop.

|

Sure, part of this is that we’re no longer fighting former President Trump’s trade war with China. But there are bigger forces at work. First, I’ve said before that the rest of the world wants to eat like hungry Americans, and the Chinese are no different. The Chinese diet is changing to include more meat.

How does that affect grain? Well, China’s pig farms are recovering from a disease that wiped out many herds in the past few years. More pigs mean more demand for grain. China is eager to boost its domestic meat production, which is sending imports of grain through the roof. And China is likely to continue its massive corn imports for the foreseeable future in order to feed its livestock and satisfy the nation’s increasing demand for meat.

Meanwhile, the pandemic is ending — in fits and starts. That means economic activity is picking up and more people are eating out. That means meat consumption is only likely to go higher. And again, that boosts grain imports.

So, how can you play this rally in corn and other grains? I have a couple ideas.

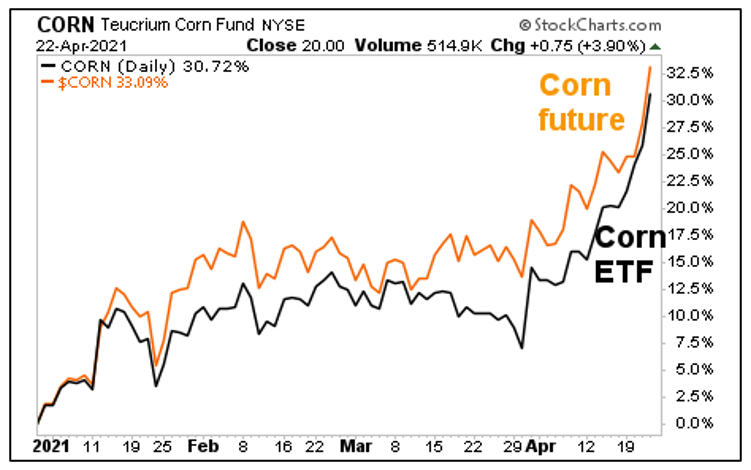

The first is the Teucrium Corn Fund (NYSE: CORN). This exchange-traded fund (ETF) tracks three futures contracts for corn that are traded on the Chicago Board of Trade. It’s very direct exposure to corn prices, tracking the price closely, as you can see from this chart …

|

The CORN ETF is liquid, so you can trade in and out easily. Be aware that it has an expense ratio of 2.47%, which I consider high.

Another way to play the trend is with the Archer-Daniels-Midland Company (NYSE: ADM). One of the world’s largest agribusiness companies, ADM operates in grain trading and processing. So, it makes all kinds of money as grain prices go higher. And while ADM has lagged the big move in corn, it’s just starting a breakout.

|

My Wealth Megatrends subscribers bought this stock not long ago, and they are already racking up double-digit percentage open gains. The recent breakout opens the door to much higher prices. We also own it because ADM is a dividend raiser, and dividend raisers tend to outperform the markets in good times and in bad.

However you want to play it, you shouldn’t miss out on this bull market. To riff on the old “Oklahoma” song, corn prices are going as high as an elephant’s eye. The gold rush in corn is just beginning.

All the best,

Sean