Have you seen the price of aluminum lately? Wowza! This most useful of industrial metals just rallied to a three-year high!

In the shorter term, aluminum is up 32% year to date, and it could kick into even higher gear. This is due to one major reason …

|

First, aluminum is a very light metal, which makes it very useful in everything from building to everyday items like food packaging and beer cans to iPhones to cars.

And as the global economy steps on the gas, aluminum demand put the pedal to the metal.

Second, since aluminum is so light, it’s crucial for electric vehicles (EVs), where every pound counts. A recent analysis shows the average amount of aluminum used in EVs is 30% higher compared with internal combustion engine (ICE) vehicles.

So, aluminum is ramping up along with EV sales.

|

One forecast from analysts at Eccomelt is that demand for aluminum over the next 15 years will increase to nearly 10 million metric tons! That’s a tenfold rise from 2017. Most of it will have to do with the surge in the number of EVs on the road.

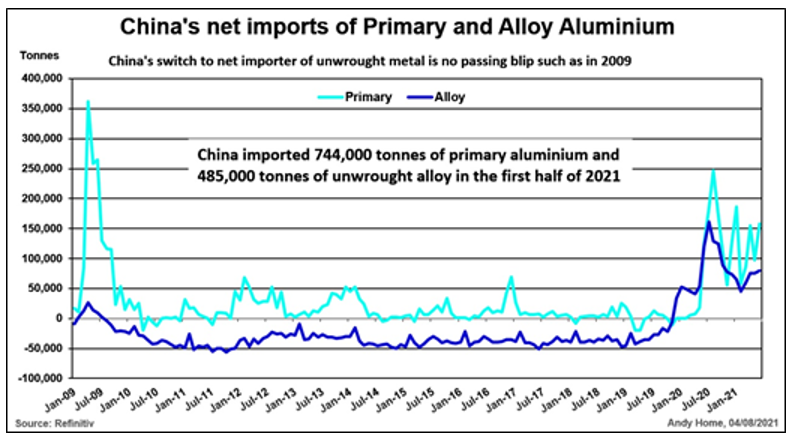

Third, China is clamping down on its own aluminum production to curb pollution. About 81% of Chinese aluminum production is tied to coal-fired power. China’s latest Five-Year Plan calls for an 18% reduction in carbon intensity per unit of GDP by 2025, as well as a 13.5% reduction in energy consumption.

To reach both targets, China must produce LESS coal pollution. This means China needs to import MORE aluminum, as this Reuters chart shows:

|

In fact — hold the phone! News broke Friday morning that China’s autonomous region, Xinjiang, has required five local aluminum smelters to curb output from August.

Wait! There’s more news breaking. Bloomberg reports that a seasonal power crunch is squeezing metal producers in China’s southern provinces. That’s a drain on supply when demand for aluminum is booming!

So, what do you think that chart is going to look like going forward?

As a result of China hoovering up all the aluminum it can find, premiums are rising in the spot market in Japan, the U.S. and Europe. And new contracts are being signed at higher prices.

What to Buy … and What Not to Buy

You can play this move with stocks of the better aluminum makers. That’s what subscribers to my Gold and Silver Trader are doing.

Or you can buy exchange-traded funds (ETFs).

IMPORTANT: Always do your own due diligence, but I strongly recommend staying away from the strictly aluminum ETF.

The strictly aluminum ETF is the iPath Series B Bloomberg Aluminum Subindex Total Return ETN (NYSE: JJU). It has very little volume, averaging less than 1,000 shares a day.

So, while you might be able to get into this fund, you’ll have the devil’s own time trying to get out at a decent price.

A much better choice is the Invesco DB Base Metals Fund (NYSE: DBB). This fund tracks a basket of futures contracts, including aluminum, zinc and copper.

Guess what: I’m bullish on zinc and copper, too! And DBB is plenty liquid, averaging more than 280,000 shares per day in volume.

Let’s look at DBB’s chart:

|

You can see that DBB has consolidated for months. However, it just broke its downtrend. Its next move could be a rocket ride.

Whatever you do, make sure to do your own research first. And hang on to those beer cans. They’re going up in value.

All the best,

Sean