Electric vehicle (EV) stocks are shifting into higher gear.

I’ve explained why in recent columns like here, here and here.

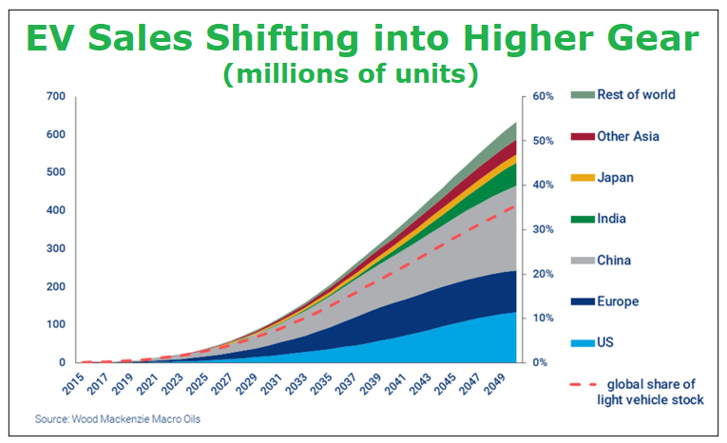

While EVs still account for a small part of the market — 6.9% — the smart money can see that sales are about to shift into higher gear.

And as sales boom, these stocks are going to ZOOM!

You should get a piece of that. That’s why today, I’m giving you a brief run-down on three exchange-traded funds (ETFs) that will let you ride the EV boom.

Importantly, all three funds are liquid, so you can buy — and sell —them easily.

Fund 1: DRIV

The Global X Autonomous & Electric Vehicles ETF (NYSE: DRIV) holds a basket of stocks that tracks the Solactive Autonomous & Electric Vehicles Index. This is ETF holds cars involved in EVs, as well as autonomous driving, which includes not only car manufacturers, but also chip makers, other auto components, communications, software, electronics and more.

About 22% of the fund’s holdings are auto manufacturers, while another 22% are semiconductors. And its holdings are spread around the U.S., China, Japan, South Korea, Germany and other countries.

DRIV’s top five holdings are Alphabet, Inc. (Nasdaq: GOOGL), Microsoft Corp. (Nasdaq: MSFT), Intel Corp. (Nasdaq: INTC), NVIDIA Corp. (Nasdaq: NVDA) and Apple, Inc. (Nasdaq: AAPL).

If Google and Apple surprise you, both companies are in talks to roll out their own cars, and recently Google announced a six-year partnership with Ford Motor Company (NYSE: F) to bring Google apps and over-the-air software updates to Ford vehicles.

The first actual car company held by DRIV is Tesla, Inc. (Nasdaq: TSLA) at No. 6, followed by Toyota Motor Corp. (NYSE: TM) at No. 8. The fund has an expense ratio of 0.68%.

Fund 2: IDRV

The iShares Self-Driving EV and Tech ETF (NYSE: IDRV) holds a basket of electric vehicle, battery and autonomous driving technology stocks. IDRV has an expense ratio of 0.47%.

This fund’s top five holdings are Tesla, Alphabet, Intel, Samsung and Apple. Toyota is No. 6. With such similar holdings, IDRV’s performance must match that of DRIV, right? Wrong! I’ll show you a chart on that in a bit.

Fund 3: BATT

The Amplify Lithium & Battery Technology ETF (NYSE: BATT) focuses on the battery supply chain as well as battery storage. That means it holds miners of lithium, cobalt, nickel and copper. It has an expense ratio of 0.59%.

One of the great things about this fund is it has exposure to stocks that aren’t easy for Americans to buy. Its top holding is China-based battery maker Contemporary Amperex Technology. That’s followed by Tesla, mega-miner BHP Group (NYSE: BHP), China-based electric car company BYD Co. (OTC Pink: BYDDF), and LG Chemical (OTC Pink: LGCLF).

As you can probably tell, BATT is heavily weighted toward China, with 38% total invested in Chinese firms. About 13% of its holdings are headquartered in the U.S, and it also has holdings in Australia, South Korea and more.

So, three different funds. Which one do you want to buy? If recent performance is any guide, this three-month performance chart should help …

Over the past three months, IDRV is up 26.93%, DRIV is up 41.56%, and BATT is up a whopping 49.03%. That’s a wide range of performance.

But even if you took the laggard of the three, you’d still be driving rings around the S&P 500.

Over the same time frame, the S&P is up 10.2%. That’s normally respectable. But in the EV boom, that’s sleepy.

Bigger gains are around the bend. I already have my subscribers busy in this industry. Don’t get left behind!

All the best,

Sean