3 Reasons Why Gold & Miners Are Headed Higher in 2021

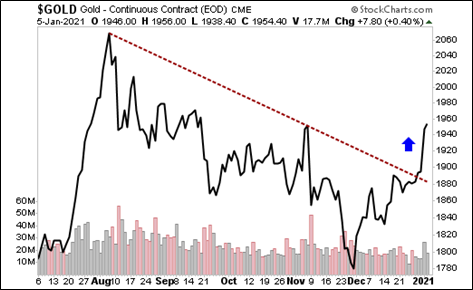

After five months of disappointment, gold is back in rally mode. It had a great December, and it’s having a strong start to January. In fact, gold broke its five-month downtrend.

Bullish volume is strong too. This tells me that the “on” switch has been flipped for gold’s big bull market. Pullbacks will likely be short-term and a buying opportunity.

Consider these three fun facts.

Fact 1: Gold Is Cheap, Miners Are Cheaper

The NYSE Arca Gold Bugs Index (NYSE: ^HUI) is a basket of the 15 biggest gold miners. It’s also been around since 1996, so we use it for historical comparisons. And what history is it telling us? That right now, gold miners are dirt-cheap!

Here’s a chart of this index divided by the S&P 500 …

You can see that gold miners are off their lows, sure, but they’re still very cheap. As cheap as they were in 2002 — right before a big rally!

In fact, a recent note from commodity investment house Sprott pointed out that gold is significantly undervalued compared to the S&P 500 on other metrics, too. Analysts at Sprott said the S&P 500 Index trades at 16.3 times EV/EBITDA (Enterprise value divided by earnings before interest, taxes, depreciation and amortization, a common valuation metric). Meanwhile, gold miners trade at 7.6 times EV/EBITDA. That’s a 50% discount.

Fact 2: Mom-and-Pop and Wall Street Investors Are Both Stocking Up

According to its latest sales numbers, the U.S. Mint sold 884,000 ounces of its American Eagle gold coins in 2020. That’s more than a five-fold increase, up 455% compared to 152,000 ounces sold in 2019.

Meanwhile, on Monday alone, exchange-traded funds added 559,668 troy ounces of gold to their holdings. That was the biggest one-day increase since Sept. 21, 2020.

Then, on Tuesday, ETFs added ANOTHER 56,320 ounces of gold, bringing this year’s net purchases to 624,327 ounces. Sure, the year just started, so we can’t say for sure this will continue. That said, we’ve also seen 10 straight days of gold ETFs adding more metal.

Fact 3: Silver Demand Is No Slouch

The final numbers aren’t in yet. But it looks like physical-silver investment hit a five-year high in 2020, accounting for 236.8 million ounces. The U.S. saw the greatest increase, with investment demand climbing 62%.

These are all shorter-term forces. Place them against a background of tightening supply and demand, the solar-power megatrend that is gobbling up more silver and central banks around the world printing to infinity … and you can see the longer-term implications.

Now let’s add in a bonus force: The Democrats just won two U.S. Senate run-off elections in Georgia. There will still be plenty of legal wrangling, but that probably means that Democrats control the White House, the Senate and the House of Representatives for at least the next couple years.

That likely means …

- TRILLIONS more in fiscal stimulus.

- The Fed monetizing additional deficits.

- Tax breaks for clean energy and infrastructure.

And that means big and BIGGER deficits are on the way. The Fed’s money presses will have to run at warp speed. No wonder the U.S. dollar is slumping lower. And it’s likely to go a lot lower yet.

Since precious metals are priced in dollars, as the currency weakens, gold and silver usually go higher.

Bottom line: 2021 could be a great year for precious metals.

You probably already own gold and silver miners. So, you can just sit around and watch the next leg of the rally, right? Sure. Or you can do what we’re doing in Gold & Silver Trader.

I recommended my subscribers add two picks leveraged to precious metals on yesterday’s pullback.

The usual suspects, like the VanEck Vectors Gold Miners ETF (NYSE: GDX) and the Global X Silver Miners ETF (NYSE: SIL), will probably do very well. But individual stocks offer real outperformance.

Roll up your sleeves, get out your charts and calculators and find those winners.

Because I think this bull market has a LONG way to run.

All the best,

Sean

P.S. — Gold is a great “store of value” asset. But if you’re looking to earn more income from your investments in 2021, I recommend signing up for Martin Weiss’s “South Florida Income Miracle” this coming Tuesday, Jan. 12 at 12 p.m. Eastern.

In this event, he’ll explain how it’s possible to generate up to $1,000 a week in income. Best part, this event is completely FREE. Click here to save your seat.