Last year — a non-presidential election year — candidates and outside groups hoping to influence the midterms spent nearly $9 billion on advertisements. What do you think they will do in a presidential year?

At least $6 billion, according to one forecast …

And if you are about to say “but next year is the presidential year” … buddy, just look at how many political ads you see NOW.

A recent analysis by Kantar Media/CMAG shows that political ad spending in this election cycle is running 34 TIMES what it was at this time in the previous (2016) election cycle.

You can bet that share prices of companies leveraged to the coming flood of political ads will go up in advance of tsunami-level spending during calendar-year 2020.

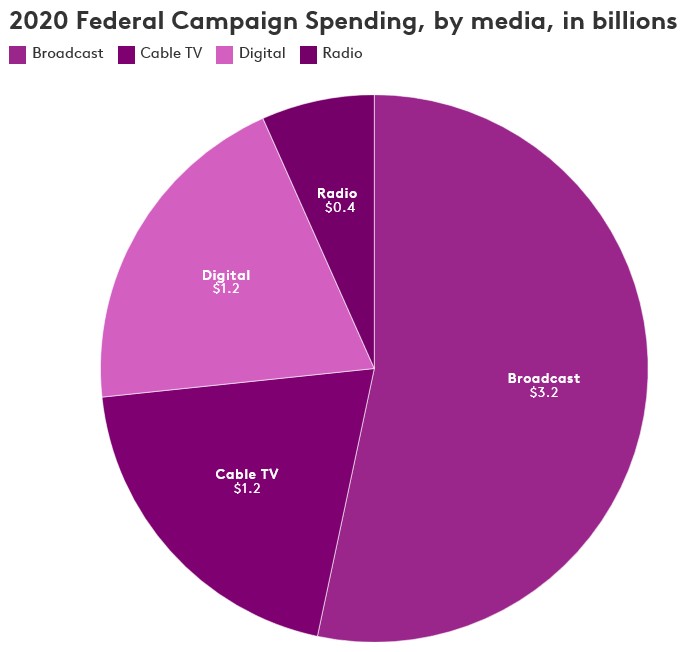

While it’s true that digital ad spending — Facebook, Google, Twitter and others — is rising fast and dominating the headlines … there’s still a giant gusher of money pointed at “old media” like TV.

And that’s good news for the Communication Services Select Sector SPDR Fund (NYSE: XLC). Along with Facebook and Alphabet, it also holds “old media” companies like Comcast, Disney and AT&T. No wonder it is up 31% from its lows in late December.

That’s not a bad-looking chart. You can see that the fund has trended higher all year. It is trying to break out, and is now testing former overhead resistance as support. If this breakout holds, it gives us a price target of $75 per share!

Heck, this fund even pays a small dividend.

But I’ve uncovered an even better play …

This company has transformed itself over the past couple of years.

After gobbling up its competitors, it now has a solid portfolio of popular TV networks and programs, and multiple direct-to-consumer streaming video services. And it’s set to reach upward of 70 million subscribers.

But it’s their advertising division that really has me jacked:

Next-generation TV planning … campaign management … best-of-the-best measurement capabilities …

In other words, the ability to give ad-buyers better targeting for their ads.

And that’s exactly what political campaigns are looking for.

The cherry on top is that this company is also taking a big lead in 5G, which means faster streaming …

Which means more streaming.

Which means more revenue … and more of that targeted advertising I just mentioned.

[There’s only one way to get access that name.]

Political noise machines on both sides are just starting to rev up for the 2020 election. There are going to be so many ads on TV you’ll get sick of them long before the election. And one company will be there to cash in all the way.

Wouldn’t you like to know what it is?

Then why not try a trial subscription to Wealth Megatrends?

All the best,

Sean Brodrick

P.S. My colleague Jon Markman is talking a lot about 5G these days. And for good reason, as there’s about to be a lot of spending on these networks AND the innovations they’re about to make possible. He just wrote about why Verizon will be a surprise winner in the coming 5G world. Check it out!