If you’re wondering what to invest in for 2021, I have an idea for you: Renewable Energy. Solar and wind are in a massive megatrend, and it’s going to power up profits for investors.

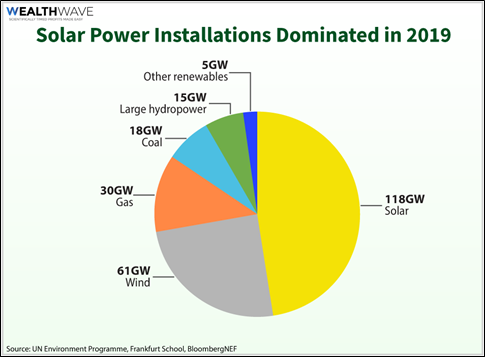

Here’s a fun fact: Two-thirds of the new power generation added in the world last year was solar and wind — a total of 119 gigawatts (GW). That’s according to a report from BloombergNEF.

The report adds that renewables, including hydro, accounted for 27% of total power produced last year, up from 20% in 2010.

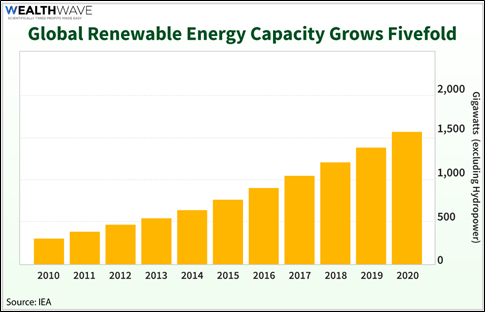

And the International Energy Agency (IEA) has its own good news. The IEA says global renewable power generation — excluding hydro — has increased five-fold since 2010.

Looking ahead, nearly 90% of new electricity generation installed this year will be renewable, with just 10% powered by gas and coal. If this trend continues, renewable energy will become the world’s largest power source by 2025, displacing coal, which has dominated for the past 50 years.

What about natural gas? Installations of new natural gas plants fell to a 10-year low.

How about the United States? Well, the U.S. solar market hit a record in the first quarter of this year, installing 3.6 GW. That’s according to a report from the Solar Energy Industries Association (SEIA) and Wood Mackenzie. In fact, thanks to utility-scale solar, the American solar market is projected to grow 33% this year, after record installations last year.

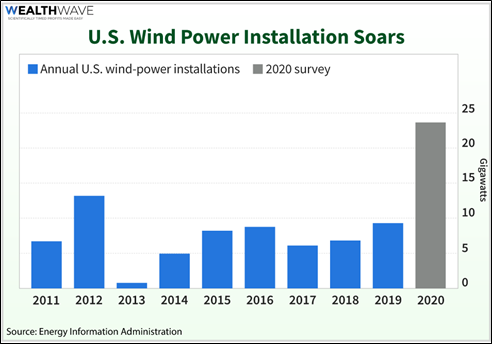

And the Energy Information Administration predicts that solar and wind energy will be the “fastest-growing source of electricity generation in 2020.” The EIA projects the installation of 23.2 GW of new wind capacity and 12.6 GW of utility-scale solar capacity.

And worldwide, wind power generation is forecast to increase by 80% in the next five years.

The COVID-19 pandemic is having an impact on solar and wind installations. It’s slowing them down, but not stopping them. Solar installations in the first quarter represented 40% of all power sector additions that quarter, according to SEIA, but construction delays and reduced demand should drop installations in the rest of the year.

Still, now that we have vaccines in the works, it’s likely the solar train will get back on track.

Will There Be a Biden Boost?

President-elect Joe Biden has laid out a plan for big investments in green energy. While he can accomplish some things on his own, a big chunk of his plan will depend on whether the Democrats are able to win two Senate run-off elections in Georgia. So, a lot of what Biden could do for the renewable energy industry is up in the air until those races are decided in December.

Anyway, here is a summary of the top five things Biden would like to do, taken from materials he’s published previously …

1. Spending $400 billion over the next 10 years on advancing renewable energy, along with launching a new agency dedicated to climate technology research.

2. Set methane and pollution limits on coal and gas plants.

3. Deploy new clean energy technology to drastically limit emissions in the agricultural sector. Joe Biden is looking to reduce the U.S. carbon footprint reduction by 50% before 2035.

4. Renew the Solar Investment Tax Credit (ITC), which started at 30%, but drops to 26% this year, 22% in 2021 and zero in 2022. This tax credit has seen an average increase in installations of 54% since it began.

5. Boost renewable energy production fivefold in the next decade. That will take it from roughly 100 gigawatts (GW) of installed capacity today to around 350 GW by 2025 and 500 GW by 2030.

A Global Megatrend

What if the Democrats lose those run-off elections — they must win both to stop the Republicans from having a Senate majority — and Biden’s green dreams are choked off? Well, then the rest of the world will move on without us, because renewables are a global megatrend.

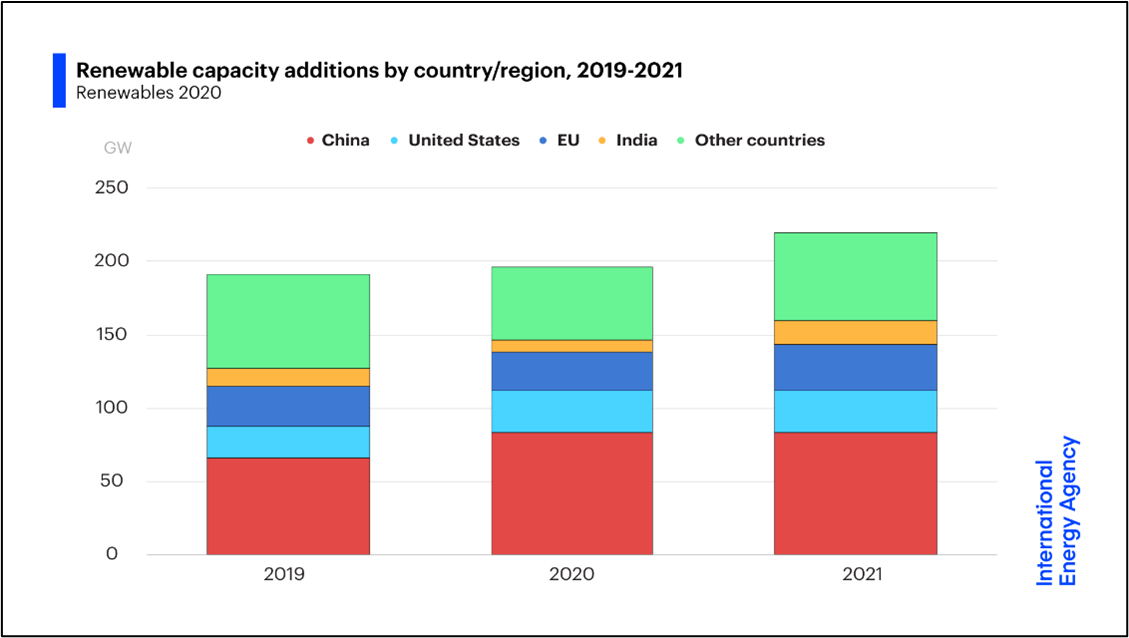

Here’s a chart from Fatih Birol, Executive Director at the IEA. It shows renewable energy installations by country and region, including those already planned through 2021.

You can see that the biggest installer of green energy is China. The U.S. is running about even with Europe … for now, anyway.

So, how can you play this? You can find individual stocks, and do the hard work of researching them. Or, you can buy exchange-traded funds that hold baskets of stocks. Two ideas would be the Invesco Solar ETF (NYSE: TAN, Rated B) and the First Trust Global Wind Energy ETF (NYSE: FAN, Rated B-).

The future is bright for renewables. You should get a piece of this action.

All the best,

Sean