Why Does Gas Cost So Much When America Pumps So Much Oil?

Are you feeling the pain at the gas pump? Yeah, gasoline prices are at their highest for this time of year since 2014. But then we keep hearing that U.S. oil production is hitting new highs. How can that be right? More supply should mean lower prices.

Let me show you why this is happening in a couple charts. I’ll even throw in a way you can make money to offset those high gas prices.

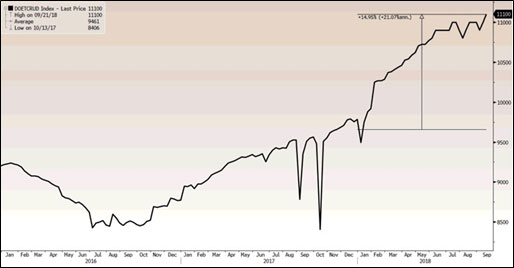

First, yes, U.S. oil production is rising. In fact, it’s soaring. I made a chart on my Bloomberg terminal about that …

Not only is U.S. oil production up about 86% since early 2016, but U.S. oil production has jumped 15% just this year alone! Wowza!

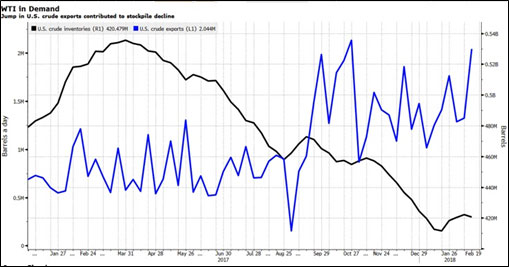

So, why aren’t prices going down? I made a chart on my Bloomberg terminal about that, too.

The black line is U.S. commercial inventories; the blue line is exports. As you can see, exports are going up, and inventories are going down. So, we are producing more oil … but we are exporting more of it than ever. We export petroleum products including gasoline, too.

And THAT, more than other factors, is what is keeping gasoline prices higher.

In a recent column, I said this could change in a heartbeat if the U.S. released oil from its Strategic Petroleum Reserve. Well, Energy Secretary Rick Perry must have been reading my mind. That’s because on Wednesday, he said that Uncle Sam ISN’T planning to tap emergency stockpiles to prevent prices from surging.

What do you suppose that did for oil prices? It turned up the heat, that’s what!

That’s one of the reasons why the price of West Texas Intermediate, the U.S. oil benchmark, just hit its highest price since July. And Brent crude, the international benchmark, hit a four-year high on the news!

Frankly, I don’t think you should look for any relief at the pumps anytime soon. And I’m not the only one.

Patrick DeHaan, head of petroleum analysis for GasBuddy, said in press reports on Thursday that with the tighter oil market and OPEC’s inaction, “gas prices may not see the typical decline we had been expecting as recently as the last two weeks.” He added: “That’s not going to be good news for motorists.”

Yeah, I think not.

How You Can Profit

Do you want to balance out your gas pump pain with some stock market gain? Sure you do.

I’m going to recommend an energy ETF. And not all ETFs are equal.

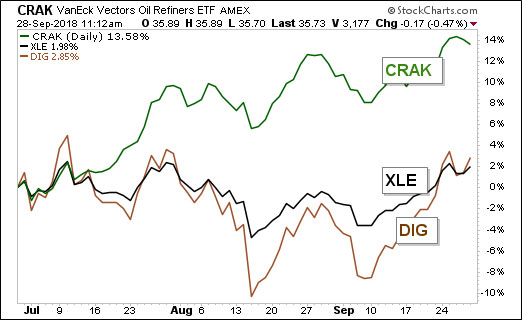

Here’s a chart of the recent performance in the VanEck Vectors Oil Refiners ETF (NYSE: CRAK) … the Energy Select Sector SPDR (NYSE: XLE), the oil industry benchmark … and the ProShares Ultra Oil & Gas ETF (NYSE: DIG), a leveraged oil industry fund.

Considering that DIG is two-times leveraged to its underlying index, the fact that it isn’t outperforming XLE is a disgrace.

But look what’s running rings around the others. That’s right, CRAK! This basket of oil refiners is leaving other industry ETFs in the dust.

Another great thing about refiners is that many of them pay nice dividends. Some even raise those dividends regularly.

Interesting, eh? That’s why I just recommended another refiner to my Wealth Supercycle subscribers yesterday. I expect that pick to outperform CRAK and the oil industry generally. And it pays a dividend all the way.

If you’re doing this on your own, please be careful. But don’t get trapped in analysis paralysis, either. If you don’t want to do the research, or follow along with my Wealth Supercycle picks, then CRAK will do just fine.

This is a big trend, and $100 oil lies ahead.

All the best,

Sean