This week saw gold give back recent gains, but that’s okay. Nothing goes up in a straight line.

If you’re smart — and you probably are if you’re reading this — then you know gold is in a big bull market. And in bull markets, pullbacks can be bought.

First, let’s look at why precious metals are poised for profits. Then, I’ll share some names I’m watching ….

All the Easy Gold Has Been Found

It’s true — all the easy-to-discover-and-mine gold has been found. There are mines starting now that used to be low-grade spots in the road that miners would drive over to get to the good stuff.

What’s this mean? Lower supply.

In a recent report, S&P Global Market Intelligence said that over the past decade there have only been 25 big gold discoveries. What’s more, the past three years have produced NO major new gold discoveries. Nada. Zip.

Kevin Murphy wrote in the report:

While there are still plenty of gold assets to be developed, the lack of new major deposits being discovered means that the project pipeline is increasingly short of large, high-quality assets needed to replace aging major gold mines.

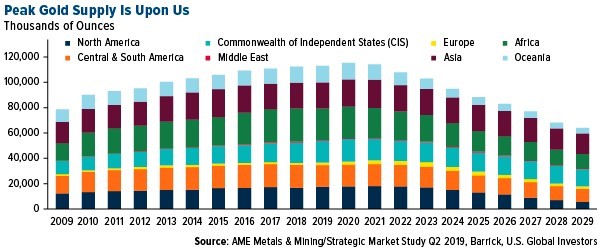

You know what that means? Peak Gold! And by that, I mean that we are rapidly approaching the point where global gold production will top out and go into decline.

That’s a chart from Barrick Gold and U.S. Global Investors showing the forecast peak in gold supply from mines. The big trend in supply is down. That should push prices up.

Global Central Banks Poised to Buy More Gold

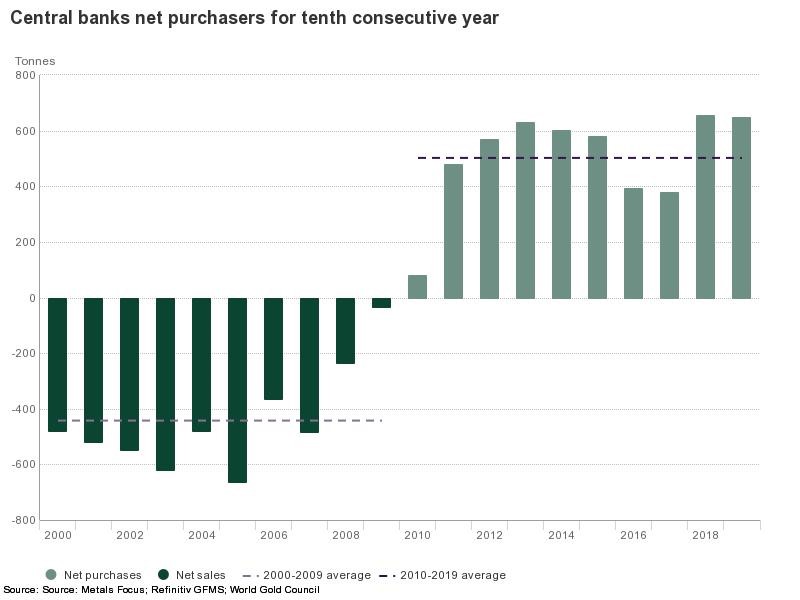

The World Gold Council (WGC) expects the number of central banks buying gold to ramp up this year.

Based on the recent WGC survey, 20% of central banks intend to boost gold reserves over the next 12 months. This is up from just 8% in previous poll. Last year, 22 central banks were net buyers of gold, up from only eight in 2010.

So, this latest change in sentiment is really something because last year, central banks bought a lot of gold. It’s a continuation of a trend — central banks have bought gold for 10 years in a row.

I guess they’re going to make it 11 years in a row. The central banks say they’re buying more gold due to uncertainty caused by the COVID-19 pandemic. But I think the fact that many central banks are blowing out their balance sheets and taking on debt to jumpstart stalled economies probably plays into it.

And it’s not just gold that investors should be watching …

Gold and Silver ETFs Are Buying with Both Hands

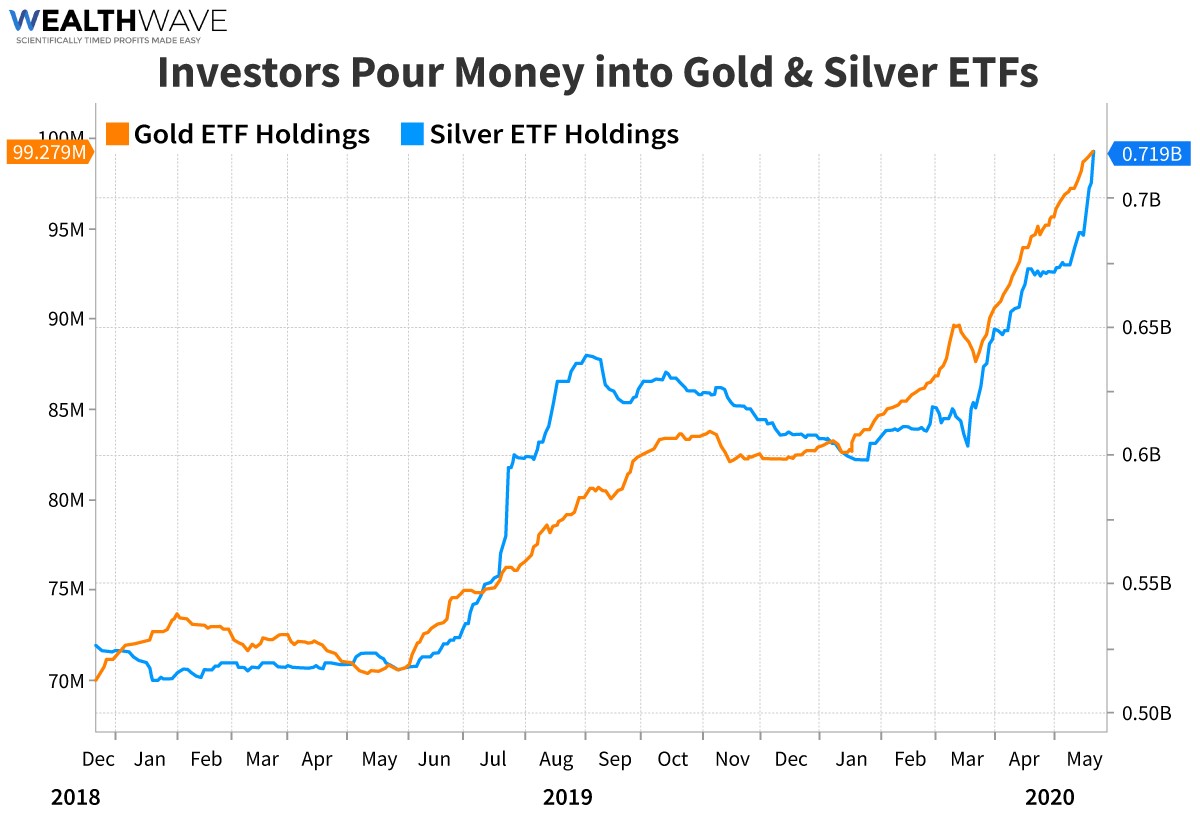

Just yesterday, Bloomberg reported that inflows into ETFs that hold physical gold totaled $16.8 billion in less than five months. So, in the first five months of this year, gold ETFs brought in more than they ever have in any entire year!

That’s impressive. But you know what else is going on? Silver ETFs are buying metal with both hands.

Now, we can see that gold ETFs hold 99.279 million ounces, and silver ETFs hold 719 million troy ounces.

ETFs have now posted gold inflows for 20 business days in a row, with another 154,000 ounces going into vaults Thursday, meaning year-to-date gains of 20%. That’s according to a note from BMO Capital Markets.

The note continues:

This is fast being caught by silver, where holdings are now up 18% YTD after a 12.1-million-ounce inflow yesterday.

Silver tends to outperform when there is an expectation that the industrial cycle is past its worst, and of course when gold is on an uptrend. Both are the case at present, plus we see signs of increased retail interest, which is crucial for silver-price formation.

How You Can Play This

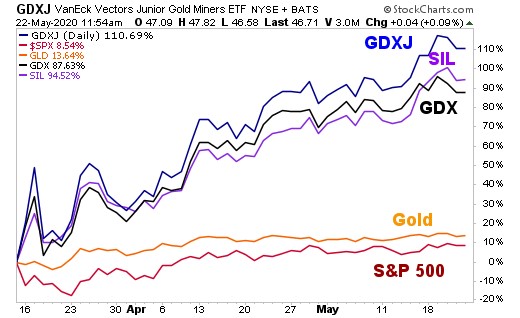

Consider buying the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ, Rating “C-”), which is outperforming both gold and big gold miners, like the VanEck Vectors Gold Miners ETF (NYSE: GDX, rating C+”), since stocks bottomed after the liquidity crash in March. And it wouldn’t hurt to buy the Global X Silver Miners ETF (NYSE: SIL, rating “D+”).

You can see that GDXJ, SIL and GDX are all outperforming gold, which is outperforming the S&P 500. That’s because miners are leveraged to the underlying metal.

For real outperformance, consider drilling down in the gold mining ETFs to individual stocks. That’s what we’re doing in Gold & Silver Trader. And it’s working out very well.

Gold is shining. Silver is next. And the better miners will make the most of it.

You should, too.

All the best,

Sean