On Tuesday, I shared my interview with Scott Melbye with you. Scott is very bullish on uranium, and he gave his reasons why. He’s also a heavy-hitter in the uranium industry. So maybe you think he’s talking his book. But if you think he was convincing, I want to share two more ideas with you today.

Profile #1: Uranium Energy Corp.

I’ve been to visit Uranium Energy Corp.’s (NYSE: UEC) Palangana uranium in-situ recovery (ISR). In this interview, Scott talked about the projects that Uranium Energy Corp. has, and what uranium price it would need to restart each of those mines.

Click on the image to watch my interview with Scott Melbye, or point your browser here: https://youtu.be/4ZTMhRVJVdg

The price target at Palangana is $40 per pound, and this past-producing operation can switch back on in two to three months, Scott said.

You can watch my video interview with Scott about Uranium Energy Corp. here: https://youtu.be/4ZTMhRVJVdg

Here are some other things to keep in mind …

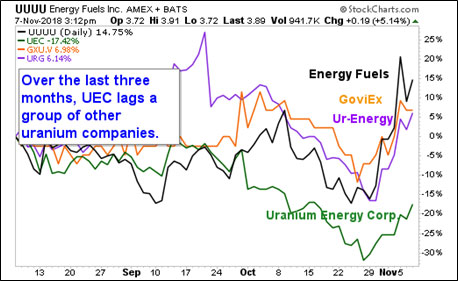

Uranium Energy Corp. has significantly underperformed its peers recently. The following chart includes the uranium industry’s recent period of correction, then a bounce.

This is probably due to the fact that the company not only issued shares to raise cash, it also doubled the size of that capital raise (to $20 million). And this happened even though, some months ago, the company said it had enough cash for two years.

What changed? From my talk with Scott, it seems the company wants to be prepared to ride the big uranium bull.

It needs money to prepare its projects. So, you could say the stock suffered from either improperly managed investor expectations or poorly timed optimism.

I have long held — in conversations with associates and my friends and peers on the internet — that the time to buy Uranium Energy Corp. is after it does one of its periodic cash raises. Then you ride it up until it hits overhead resistance. Because until it starts production, it will always have to raise cash.

Now, however, the game is changing. Specifically, Uranium Energy Corp. is going to spend money in 2019 to prepare its Burke Hollow project to go into production. Burke Hollow would feed into the Palangana project that Scott says the company can turn on in a matter of months.

Uranium Energy Corp. has other projects and properties, and you can see the company’s latest presentation here:

Also, here is a recent weekly chart of UEC.

The bottom line is that this company recently bottomed. Even if you think it is rangebound, it is still near the lower end of that range. It has a price-sensitive production target. And if you believe uranium is going higher, then Uranium Energy Corp. is on the path to production.

Profile #2: GoviEx Uranium

In New Orleans, I also talked to Daniel Major, CEO of GoviEx Uranium (TSX-V: GXU; OTCQB: GVXXF). GoviEx is a uranium explorer and developer with projects in three African countries. And it is proceeding at full speed to bring two of them into production.

Now, when I said “Africa,” some investors immediately tuned out. They’re missing an opportunity. There are parts of Africa that are scary for an investor, and parts where it’s great to do business. GoviEx is in the right parts, particularly Niger and Mali.

GoviEx is also in Zambia, which hiked mining taxes in its 2019 budget. That will scare some investors, too. But you know what? Mexico hiked mining taxes not too long ago, and there are still plenty of great opportunities in Mexico.

Heck, Mali is also talking about raising mining taxes. Governments that don’t hike taxes on miners when prices are going up are rare indeed.

Anyway, you can see my interview with Daniel here:

Click on the image to watch my interview with GoviEx CEO Daniel Major, or point your browser here: https://youtu.be/4npzF4pfuEQ

In the interview, Daniel explains how a permitting process that’s fast, among other factors, is helping him aim for a production target of 2021 on his first project. That’s the one in Niger. There are a lot of well-respected people connected with this company, as well.

These projects are big and potentially have a long life. Here’s a weekly chart of GoviEx …

So, there you have it: Two ideas. They are both developers. And as Daniel Major says in his interview, there is a real valuation difference between uranium developers and producers. If and when these companies make that transition, their re-rating could be extraordinarily profitable for shareholders.

Shares and Share Alike

Before I let you go, let’s talk about the share issuance. After all, this is a major issue some investors have with Uranium Energy Corp.

Since 2015, Uranium Energy Corp. has issued 47.36 million shares. That includes the 12.67 million it just issued in September. That’s a sizeable chunk of the 176 million shares it has outstanding. You can see why investors would be wary. It issues shares, on average, once a year.

I think anyone who buys Uranium Energy Corp. thinking this company will never issue shares again is kidding themselves. It’s the company’s business model, because it’s not making any money now.

But it’s not alone.

For its part, GoviEx issued 50 million shares in 2016; Sprott was the buyer of those shares. GoviEx has two mines it wants to build. Do you think it won’t be issuing more shares? Sure, there are other ways to finance a mine — debt and streaming contracts are two popular choices. But so is issuing shares.

Let’s look at some other popular uranium plays.

Denison Mines (NYSE: DNN) is doing well. My Supercycle Investor subscribers own it. It’s advancing a great mine project. It issued 15.1 million shares in 2016, and 18.34 million in three lots in 2017. Just this month, it announced a private placement for another 4.95 million shares. It’s expensive to build a mine.

UEX Corp. (TSX: UEX) is a popular Canadian explorer. It issued 12.92 million shares in 2017 in two lots, and 12.2 million in 2018.

Fission Uranium Corp. (OTCQX: FCUUF) is another good explorer, and one that my subscribers own. It last issued shares in 2015 — 13.34 million of them.

Ur-Energy (NYSE: URG) is an American uranium producer. That doesn’t stop it from issuing shares. It issued 12.92 million in 2016, and 12.2 million in 2018.

Energy Fuels (NYSE: UUUU) is an excellent U.S. uranium producer. It has powered to BIG open gains in both our Supercycle Investor and Wealth Supercycle portfolios. It still issues shares, though — 13.4 million in 2016. And it just filed paperwork for an “at the market” program to sell up to an additional $24.5 million shares.

Now, I’ve been talking (in person and by email) with Curtis Moore of Energy Fuels. He makes a good case for what the company wants to use the money for, a case I will share with my paying subscribers. I am very confident that Energy Fuels is poised for great success.

To sum up: Until uranium companies have steady cash flow, expect them to issue shares. If and when you buy anything in this space, it’s a given.

For many uranium companies, the best time for short-term traders to buy is right after the news of a share issuance is priced in. But if you can’t live with that risk, this might not be for you. Also, there are other good reasons to buy select uranium companies, depending on your time frame.

At the New Orleans Investment Conference, I told a packed room that “the dog days are over in uranium. It’s time to pick your horses and get ready to ride.” I’ve mentioned seven uranium companies here, and given you links to interviews with two of them. But none of this is an endorsement of any particular company. You’re in charge of your own investing destiny, and you know your own appetite for risk.

The starting bell is sounding. Get ready to ride.

All the best,

Sean