I’ve been pounding the table about a coming uranium rally. We’re not seeing a big move in the price of uranium — yet. But the action we’re seeing in uranium miners tells us that uranium could be about to surge.

What’s more, we’re seeing important players in the uranium market recently snap up the energy metal with both hands. It’s as if they know what’s coming.

The best news is you can still get ahead of Wall Street’s white-shoe crowd. And uranium has been beaten down for so long, the coming rally could be ENORMOUS. It could be enough to hand out 10-bagger returns all over the place.

Would that be enough to make you a millionaire? That’s between you and your bank account. But let me just give you some of the facts that are causing savvy traders to prick up their ears.

A Chain Reaction of Buying

First, we have to acknowledge the havoc that the COVID-19 pandemic wreaked in the uranium industry. The world’s two biggest producers, Cameco Corp. (NYSE: CCJ) and Kazatomprom in Kazakhstan, both had to shut down mines due to infections at mine sites. At one point in April of 2020, nearly 50% of primary uranium mine supply was offline. This resulted in mine supply being short of demand by about 65 million pounds last year.

Sure, there are above-ground stockpiles of uranium. I’ll get to those in a bit.

COVID-sparked supply disruptions continue into this year. As a result, mine supply should be short of demand by about 40 to 50 million pounds.

So, that brings us to stockpiles. Suddenly, everyone is interested in stockpiles.

Last week, we saw London-listed Yellow Cake plc (OTC Pink: YLLXF), a fund that owns physical uranium, suddenly make a big buy. Yellowcake announced it was exercising an option to buy $100 million worth of uranium from Kazatomprom. The price was $27.34, so that’s slightly over 3,657,644 pounds of inventory that Kazatomprom had to pony up.

Oops! Suddenly, Kazatomprom had to deliver all that uranium when it cut production (due to COVID). So, what did Kazatomprom do? It announced it may buy the nuclear fuel in the spot market.

But wait! Then, this week, Denison Mines Corp. (NYSE: DNN) announced a financing deal worth around $75 million to fund the purchase of 2.5 million pounds of uranium. Denison’s reasoning is solid. Recent spot prices are below most industry production costs. Uranium is too cheap NOT to buy.

Then on Tuesday, Uranium Energy Corp. (NYSE: UEC) said it’s going to build its own physical uranium inventory. To do that, it inked agreements worth $10.9 million to buy 400,000 pounds of uranium.

This string of news is definitely a bullish trend! Uranium miners are buying the physical commodity in the spot market and betting on higher prices in the future. This is new, and a positive for prices.

And it’s driving up funds like Yellowcake and Uranium Participation Corp. (TSX: U.TO), a Canadian fund that holds physical uranium as well as uranium hexafluoride gas, higher.

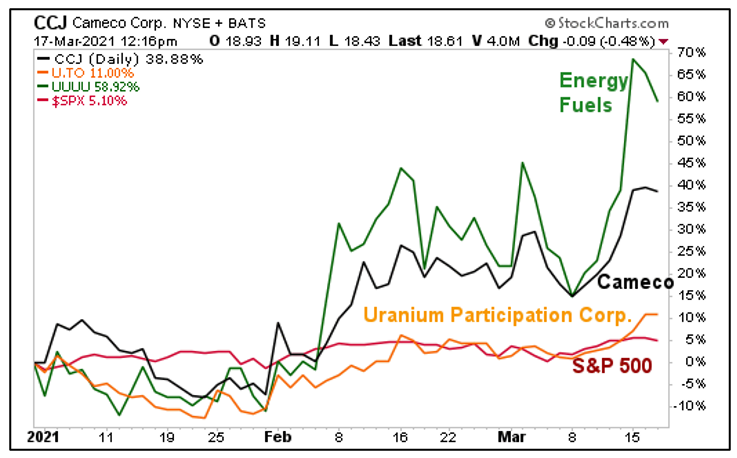

And yet, thanks to the power of leverage, uranium mining shares are outpacing the uranium funds by quite a bit. Let’s look at a performance chart of the Uranium Participation Corp. and some of my favorite uranium miners since the start of the year:

The Uranium Participation Corp. is up 11% since the start of the year, or about double the performance of the S&P 500. But for real outperformance, look at the miners. Cameco is up 38.88%. And Energy Fuels, a U.S. uranium producer, is up 58.92%!

The good news for subscribers to my Supercycle Investor newsletter is they own both of these stocks already. Heck, they’re up 62% on Cameco! And they’re up 13% on Energy Fuels Inc. (NYSE: UUUU), but we bought that much more recently. They’re still beating the pants off the S&P 500.

And you know what? We’re going to buy more stocks. Because the massive uptrend in uranium is not going to stop. As I said earlier, this is the kind of big bull market that makes millionaires.

You should think about getting aboard this uranium gravy train, too. Because the next millionaire it could make could be YOU!

All the best,

Sean